Real estate emerging funds outlook

Real estate emerging fund managers may look to niche strategies and better data to overcome the denominator effect challenge.

Real estate emerging fund managers may look to niche strategies and better data to overcome the denominator effect challenge.

How to strengthen your workforce strategy by applying the tax implications to various ways to recruit and retain employees.

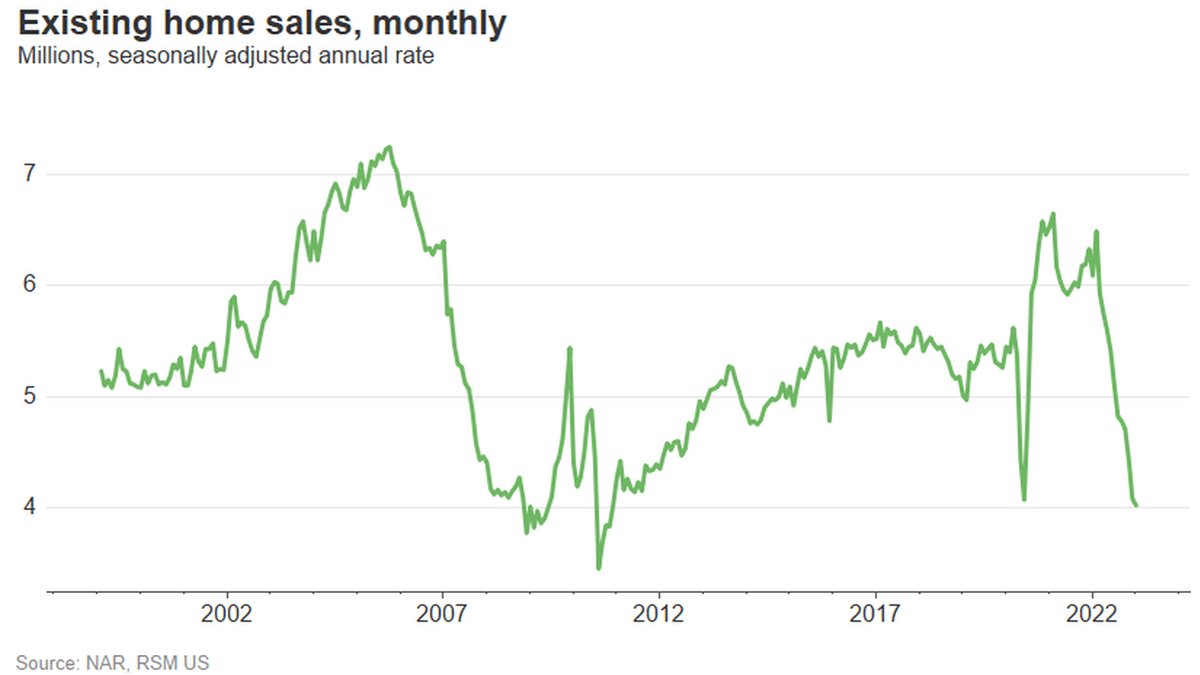

December’s sales declined by 1.5% to 4.02 million units annualized. That brought the total number of units sold last year to 5.03 million, 17.8%

Housing starts dropped by 1.4% on an annualized month-ago basis, while building permits fell by 1.6%. For all of last year, housing starts fell by 3%.

The NTA reports on the 10 most serious problems encountered by taxpayers and makes recommendations to alleviate these problems.

RSM’s experienced business owner tax advisors understand the business lifecycle from startup to business transition. We can point out potential blind spots, provide tips and lay out the best tax strategies to help ensure success.

Understand how the IRS is changing tax compliance for taxpayers with international activity for 2022.

A recent IRS fact sheet explains tax credits for energy efficient home improvements residential energy property.

SECURE 2.0 Act significantly changes the tax rules governing qualified retirement plans and individual retirement accounts (IRAs).