How to measure and manage your company’s working capital

Effective working capital management can make all the difference between success and failure in the business world. Learn how to measure and effectively manage your company’s working capital.

Effective working capital management can make all the difference between success and failure in the business world. Learn how to measure and effectively manage your company’s working capital.

The tax treatment of business interest expense is governed by Section 163(j) which places limits on the amount of interest businesses can deduct on their tax returns based on their income and other factors. Unfortunately, the calculation for determining a company’s limit has changed starting with the tax year 2022 and stands to impact many large businesses negatively.

Streamline your tax data management for efficient growth and compliance. Stay ahead of regulatory changes and provide stakeholders with real-time tax information. Discover how our tax data transformation solutions can help your business minimize risk, add value, and unlock growth opportunities. Simplify tax reporting and elevate your financial strategy today.

The SALT deduction has been a longstanding benefit for taxpayers who pay state and local taxes. However, recent limitations to the SALT deduction have left taxpayers in high-tax states looking for alternatives. One such option is the PTE tax election, which allows pass-through entities to pay and deduct state and local taxes on behalf of their owners.

Donors can amend conservation easement deeds with IRS-approved language for extinguishment and boundary line adjustment clauses.

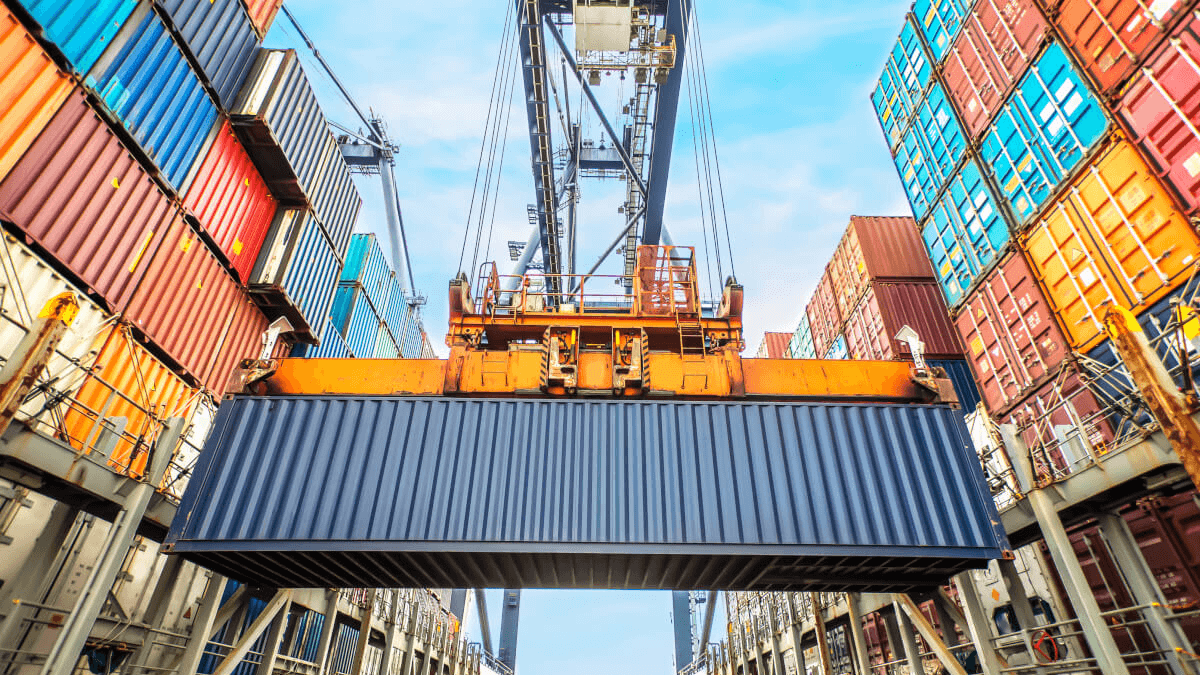

Increased export controls activities mean companies exporting goods, services and technologies should strengthen their export control protocols to avoid noncompliance.

New rules for EV credit reduce the number of eligible models after Apr. 17, 2023. The list of eligible models is likely to grow.

According to the RSM US Manufacturing Outlook Index based on those surveys, manufacturing activity remains at 1.8 standard deviations below normal.

When employers pay employees with property or stock, rather than cash, special rules under section 83 apply.