Authored by RSM US LLP

Nonprofit leaders are accustomed to doing more with less. They thrive despite limited funding, staffing, supplies and reimbursement rates. Over the past few years, however, nonprofits have had to do more with less of their most critical asset: employees.

The Great Resignation was more than a pandemic-era problem. It was part of a long-term trend in employment rates driven by several factors—although the pandemic and its economic implications certainly intensified it. Nonprofits need to accept that and prepare for this employment struggle to be the new normal—not a short-term blip.

The pandemic-era employment drop and recovery

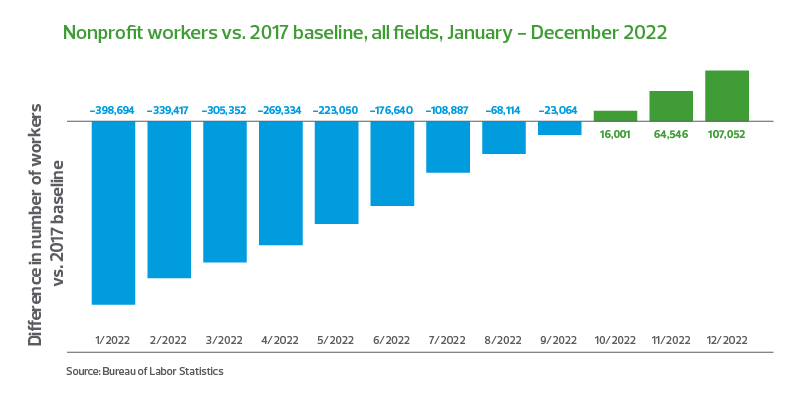

In the first three months of the COVID-19 pandemic, “nonprofits lost a conservatively estimated 1.64 million … jobs, reducing the nonprofit workforce by 13.2% as of May 2020.”[1] In fact, it wasn’t until October 2022 that the number of jobs in the nonprofit sector rebounded to the baseline measurement in 2017 (the most recent nonprofit-specific count from the Bureau of Labor Statistics).[2] The sector’s employment has continued a positive trajectory month over month, much like the American economy.

Despite staff shortages, however, the nonprofits’ work never eased up. So how did nonprofits continue serving their members and constituents? They had to get creative and work smarter.

Looking further back

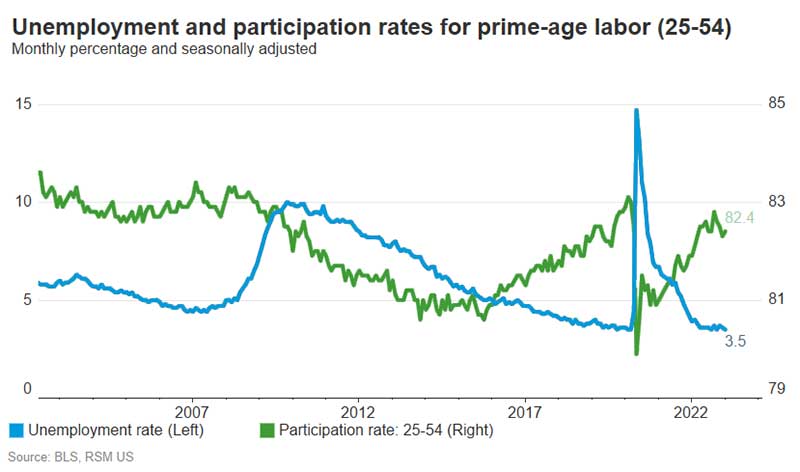

As catastrophic as the pandemic was—in the early months especially—a look further back clarifies an important trend in American employment. Since unemployment peaked around 10% during the Great Recession of the late 2000s, it has been in a steady decline toward the 3.5% rate at the end of 2022—well below the assumed natural unemployment rate (4.4%).[3] For the two years leading up to the pandemic, and then again starting in 2022, there simply were not enough workers to fill job openings. This worker shortage is noticeably true in the nonprofit sector. As of the end of 2021 (the most recent data currently available), three-quarters of nonprofits indicated that they had job vacancy rates of 10% or more.[4] Factors in American demographics, such as the Baby Boomer generation entering retirement age and the decrease in immigration rates, indicate that this trend of a tight labor market is unlikely to reverse anytime soon.

Getting creative with staffing models

Many nonprofit employees don’t have easily definable job descriptions. And as work boundaries fade, burnout and turnover can increase.

Therefore, many nonprofits have looked outside the traditional workforce for support, engaging with outsourcing firms and independent contractors. Outsourcing the nonprofit’s administrative operations has the double benefit of leveraging efficiencies and the provider’s expertise along with alleviating staff members of the burdens of critical functions like finance, human resources and information technology.

Nonprofits have long been adept at hiring consultants who are experts and leaders in their field, but what about the vast number of individuals active in the gig economy who have talents and skill sets that meet other niche needs? Independent contractors can be a useful, timely supplement to existing staff—not only as subject matter experts but in any number of mundane or routine operations. Examples for nonprofits include staffing for events, graphic and web design, and even monitoring and evaluation techniques. While nonprofit staffing is at critically short levels, outsourcing firms and the gig economy of independent contractors have never been more robust.

Working smarter with automation

In Economics 101, we learned that productivity is a function of labor (human resources) and capital (technological resources). As one decreases, the other will need to increase to maintain a consistent output level. The Great Resignation has shown this principle to be especially pertinent, with modern technological capabilities rising to the challenge of limited human resources. Nonprofit leaders may balk at terms like “artificial intelligence” and “machine learning” (though these tools are more accessible than ever). But effectively leveraging standard, modern technology can drastically reduce the human hours required for almost any task.

One area in which nonprofits commonly have an issue is financial data. Organizations may have different departments looking at the same donor or member revenue in multiple software platforms. Nonprofits can reduce the touch points and manual human engagement by half or more by using techniques like data warehousing, business intelligence tools and system integration.

The other area for significant efficiency opportunities is data monitoring and evaluation. By tracking internal and external data points and responses to activities, nonprofits can easily spot trends and analyze the effectiveness of programs, communications and campaigns to help focus resources on the most successful strategies.

The Great Resignation or the new normal?

Nonprofits need to adapt to current staffing levels with the mindset that this is the new normal. Unemployment is still historically low, and older workers are retiring in massive numbers. Rather than riding out the Great Resignation, nonprofits need to take action now to leverage nontraditional staffing models and optimize technology for their organizations. There are modern alternatives to “doing more with less,” and proactive nonprofit leaders will readily adapt to these strategies.

1 Nonprofit employment during the COVID-19 Crisis, Center for Civil Society Studies Archive

2 Nonprofit Employment Estimated to Have Recovered from COVID Pandemic-Related Losses as of December 2022, George Mason University:

3 U.S. Federal Reserve

4 National Council of Nonprofits, The Scope and Impact of Nonprofit Workforce Shortages

This article was written by Matt Haggerty and originally appeared on 2023-02-13.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/nonprofit/nonprofits-after-the-great-resignation.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Lauterbach, Borschow & Co. is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how the Lauterbach, Borschow & Co. can assist you, please call us at (915) 544-6950.